Tankers International’s Head of Research and Insight, Mette Frederiksen, shares her thoughts on 2023 market trends based on the Pool’s proprietary fixture data, and how oil and freight dynamics reshaped the VLCC market over the last 12 months.

In 2023, the VLCC market navigated many changes – from oil production cuts to sanctions being tightened and lifted, and as we publish this piece, serious disruption in the Red Sea, which sets to join the COVID-19 pandemic and EverGiven blockage as a historical disruptor for global shipping. However, 2023 also proved to be a highly lucrative year, with China’s oil demand boosting VLCC demand as crude oil exports from the US continued to reach new records.

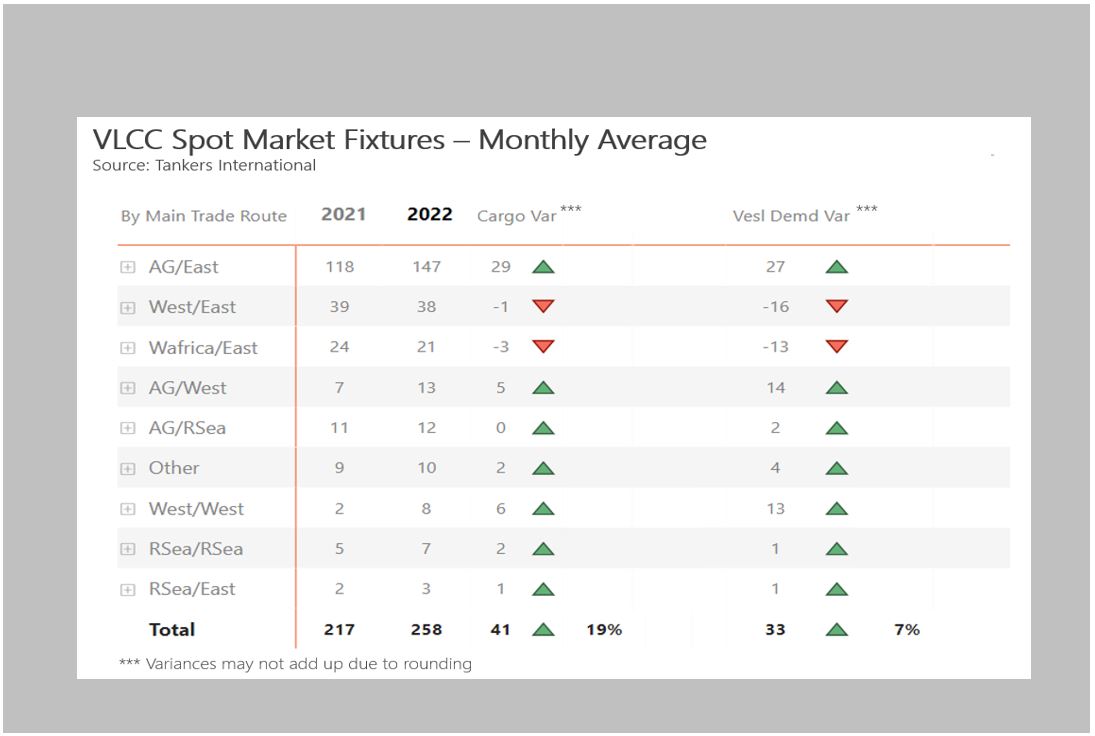

Yet, beyond the sweeping trends and statements, it’s in the detail that an interesting story emerges. Total liftings revealed an average of 282 spot VLCC cargos per month in 2023, an increase of 17 from the previous year. This 6 percentage-point growth surpasses the historical average of 4% from 2010 to 2019 (the pandemic period is ignored). Considering tonne miles as a measure of vessel demand, this also rose by 6% over the year. In the context of several rounds of OPEC+ production cuts, this sustained growth showcases the VLCC market’s resilience, with these supply cuts offset by increases elsewhere in the Atlantic basin.

Go East, crude oil flows

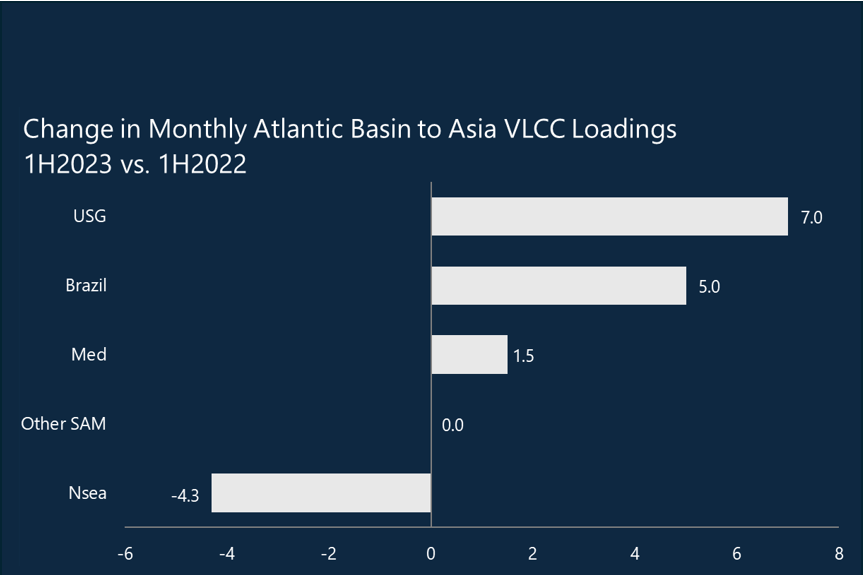

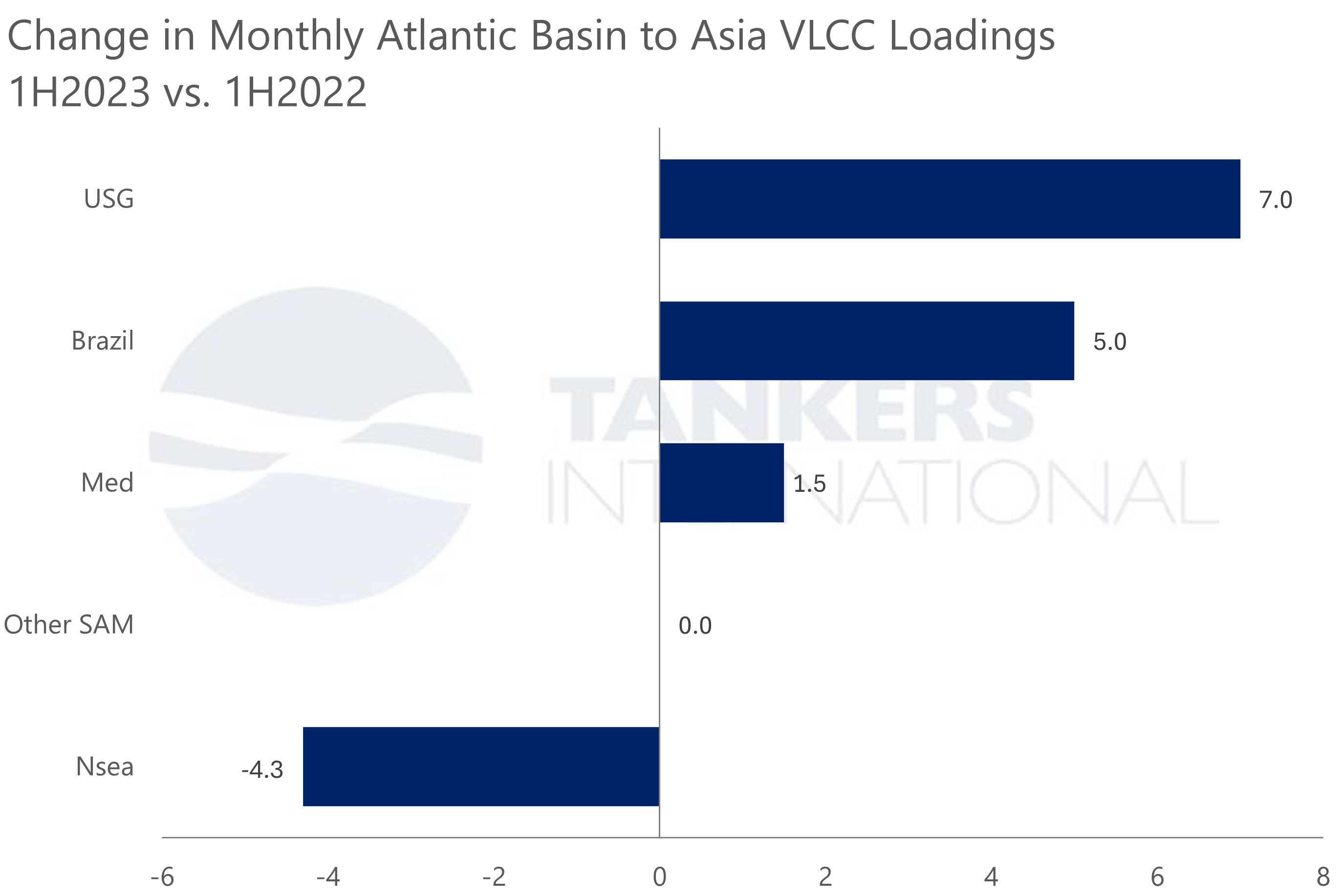

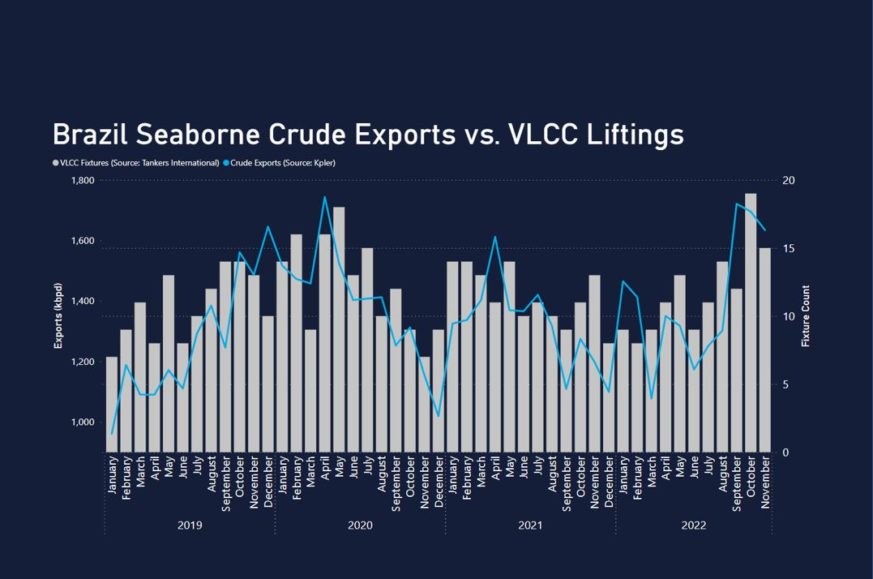

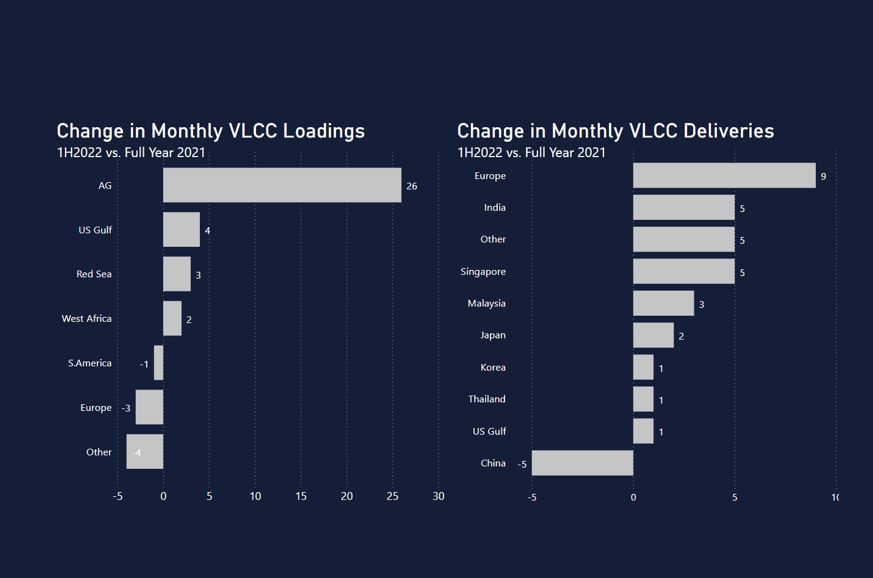

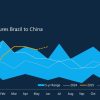

It’s clear that tonne mile development pushed global VLCC demand up in 2023. A closer look at individual trade routes uncovers where this trend emerged – from significant changes. The biggest rise in cargo counts came from the West to East route, with an additional 10 liftings each month in 2023 compared to 2022. This added demand for 26 VLCCs in full-time employment. This trend reflects developments in Atlantic basin-based crude export markets, where we saw suppliers in the US with exports reaching new records compared to 2022 of 4.21 mbpd, according to the EIA. Meanwhile, the likes of Brazil and Guyana continue to release more crude oil, combined with incremental demand growth being centred east of Suez.

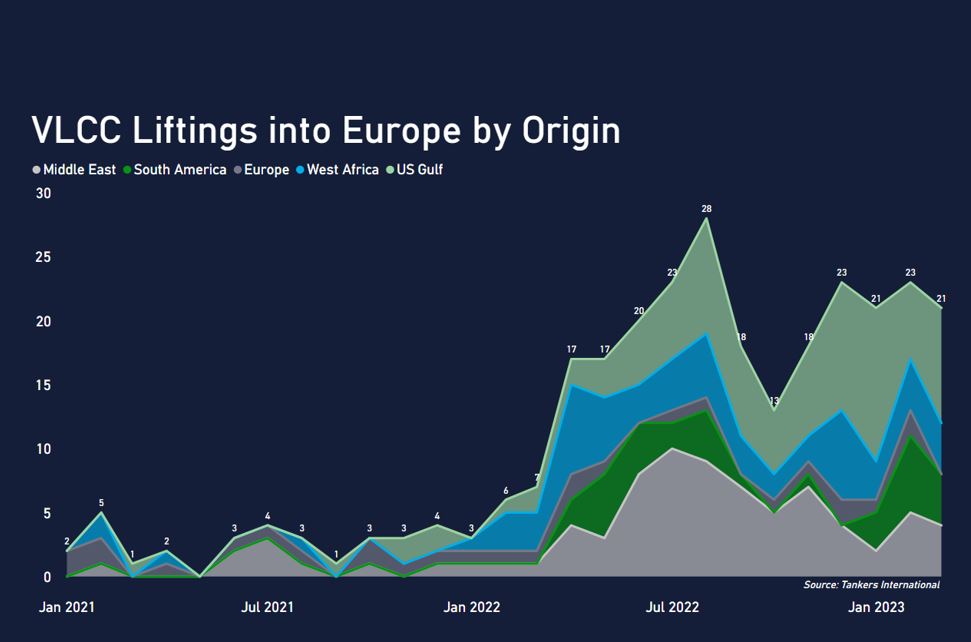

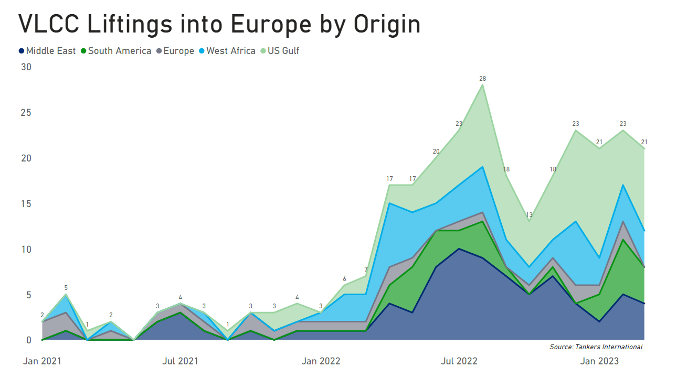

Atlantic basin suppliers have also played a key role in developments on the West-to-West trade route, which includes increasing crude volumes going into Europe following Russia’s invasion of Ukraine. Cargo counts on the West/West route have increased from circa 3 per month in 2021 to 8 per month in 2022 and an impressive 14 per month in 2023. In the final quarter of 2023, monthly liftings from the US Gulf to Europe reached double digits for the first time, totalling 11 cargos.

Our fixture data shows that the combined liftings from the US Gulf and South America (to all destinations globally) have surged by 17 per month, totalling 55 and accounting for 20% of the total cargo count in 2023. This is a 6 percentage-point increase in market share compared to the previous year.

OPEC + drama

By comparison, the Arabian Gulf (AG) share has dipped from 66% to 61%. The monthly AG cargo count for 2023 stands at 173, a decrease from 176 in 2022. As the OPEC+ alliance has been cutting supplies, fewer barrels have been available to lift in the VLCC market. We have seen liftings to Europe and the Red Sea decline, while cargo volume to the Far East marginally increased.

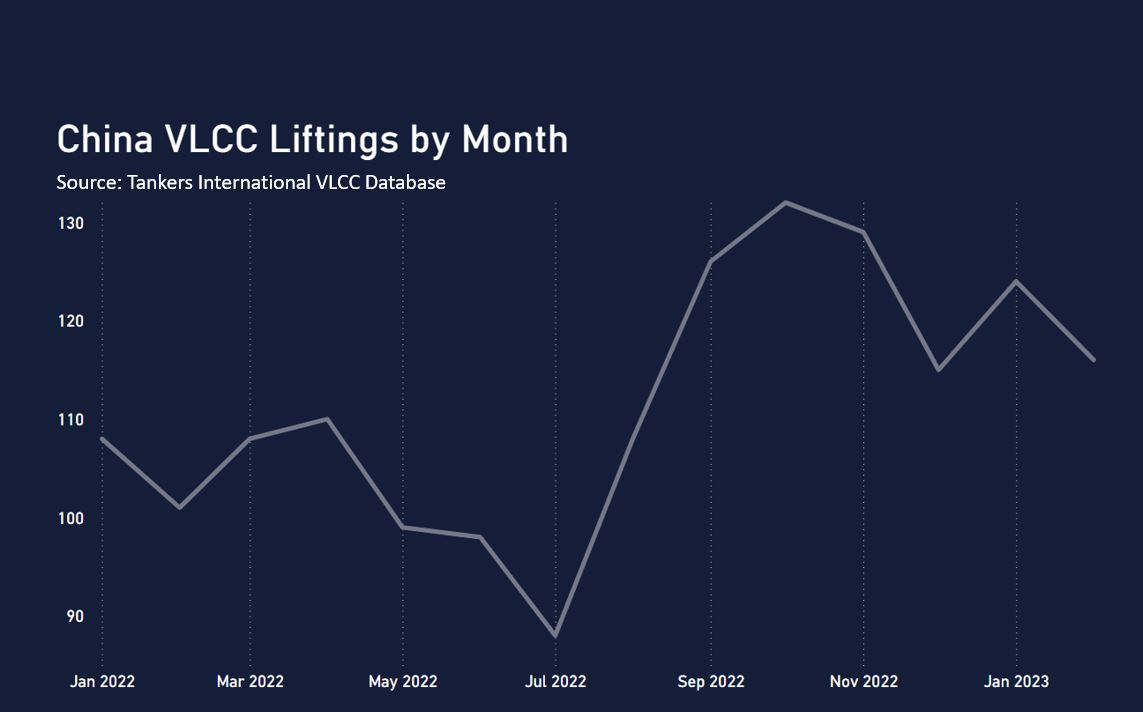

The AG to the Far East trade route continues to dominate the VLCC market in terms of total cargo volume. The liftings peaked in the first quarter of 2023, when Beijing officially ditched its zero-COVID policy. However, several rounds of OPEC+ production curbs have impacted the fixture count ever since. As the alliance has announced sustained production cuts going into 2024, we may see cargo counts plateau for the time being.

Black Swans

2023 was a year where geopolitics took us by surprise, with Venezuela back onto the scene towards the end of 2023. The release of the US sanctions on Venezuela in the last quarter drove VLCC activity out of the country to 11 cargos in December, from an average 2-5 liftings per month through the rest of the year. Chinese teapot refineries have been driving this development. We also note a rise in cargoes from Venezuela to India, signifying that Indian refineries are coming back to the market since the secondary sanctions were imposed in 2020. They now vie with Chinese teapots for the discounted oil.

Another interesting development is an additional 5 cargoes per month on the Singapore to China route. This route covers the so-called “Malaysian Blend”, which is reportedly masked Iranian barrels being re-branded and sold. The majority of these cargoes are carried by the “dark fleet”.

VLCC resurgence

It’s clear that the VLCC market has shown resilience and adapted to an ever-changing trading environment throughout 2023. The above-average increases in cargo counts and vessel demand reflect an oil market that has now recovered from the Covid crash, with demand back to pre-pandemic levels. While we may not see the same level of expansion in 2024, we can look forward to a year with a solid foundation in terms of VLCC cargo volume coupled with near-zero fleet growth. This means that any growth in cargo demand will see the tonnage supply/demand balance tighten and the freight market improve accordingly.

To stay updated on the latest market data and insight, register for the Tankers International app here: https://app.tankersinternational.com/