2023 will be remembered for many reasons. For the tanker market, it was the year that VLCC freight finally remained within positive territory for a full 12 months. But it wasn’t a smooth ride. The market had increased volatility, and earnings swung dramatically, from barely covering operating expenses to highs of $100,000 per day.

The story of the VLCC tonnage profile remains optimistic, especially when considering the limited size of the orderbook. In 2023, the global VLCC fleet took delivery of 22 new vessels, a record low number in its own right, but what is truly remarkable is that only a single VLCC is scheduled for delivery in 2024. Owners have been, and still are, reluctant to lock in new orders. This is understandable, given the prevailing record-high newbuilding prices and the uncertainty surrounding future emissions and fuel requirements. Even the most cynical observer would have to predict a bullish trend for VLCCs for the next couple of years.

Looking back, many of the same factors that drove 2022’s tanker market trends remained relevant in 2023, including Russian oil displacement to Far Eastern markets, the OPEC+ alliance curbing global oil supplies and a “dark fleet” of often older tonnage continuing active trading, when in the past they would have exited the market years sooner.

The dark fleet and sanctions

While the conflict in Gaza is causing regional disruption, the ongoing war in Ukraine is still one of the most significant factors impacting the maritime sector. Russia’s actions and subsequent sanctions redirected the country’s crude to eastern buyers, reshaping trade patterns for the VLCC segment. Europe, pushed to seek oil supplies elsewhere, turned to the US, West Africa, and the Middle East, altering tradelanes and boosting VLCC competitiveness in the Atlantic basin. With no sign of a resolution to the conflict, these newly evolved trade routes are here to stay for the foreseeable future.

The so-called “dark fleet” provokes mixed emotions. The reason for the lack of vessels exiting the trading fleet can be attributed, almost entirely, to these vessels. Given the large amount of sanctioned oil utilising this fleet at lucrative freight rates, it is easy to understand why some owners are taking this risk, especially on ships that would otherwise be certified scrap candidates. While the dark fleet does draw tonnage away from the mainstream trading fleet, many of the vessels are old and the ownership structure is unclear, which poses big questions about maintenance, safety and regulatory compliance. To change this situation, authorities would need to intensify their commitment to enforcing sanctions. Recently, Western governments have been taking action by sending letters to individuals engaged in sanctioned trades, while the European Union’s latest round of places is requiring owners in the bloc to report any vessels sold to Russian entities, for use in Russian trade, and groups that may seek to avoid the G7 oil price cap. These developments do suggest the start of a more substantial effort to enforcement as we approach 2024.

At the other end of the scale, a country that has had its sanctions eased in 2023 is Venezuela. We now see Venezuelan cargoes lifted on mainstream VLCCs, which displaces the need for dark vessels. At the end of 2023, these cargoes are currently being lifted at a premium to US Gulf cargoes. We should keep in mind that sanctions have been eased with certain conditions in place, and any untoward actions by the Venezuelan government could see restrictions reimposed. The current tensions between Venezuela and neighbouring Guyana could impact the status quo, should they escalate.

Oil and the pull from the Far East

In oil markets, the OPEC+ alliance agreed at its latest meeting to making additional voluntary production cuts in the first quarter of 2024. While there is some uncertainty around the real size of the cut and headline numbers talk of 2.2 million barrels removed from the market, the reality is that 1.3 million barrels were already off the market stemming from Saudi Arabia and Russia’s voluntary cuts already in place. The voluntary nature of these cuts, combined with recent disagreement between some member states, puts a question mark over adherence. We have also seen in the past how member states react when OPEC+ does not align with its strategic objectives, such as Saudi Arabia’s actions in 2020 and recent announcements from Angola to reject any further production cut.

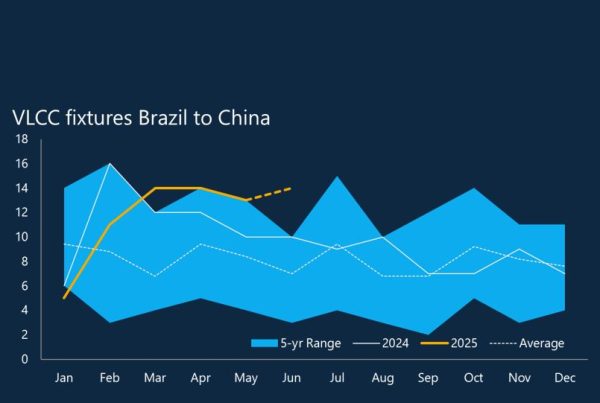

On the flip side, we observe a surge in oil production from non-OPEC producers, including an additional 1 million barrels a day from Atlantic basin producers expected in 2024. Brazil is now aligning themselves with OPEC+, and this adds a downside to current production outlooks. But this does not change the fact that the tonnemile effect from increased Atlantic Basin supply most likely heading to demand centres in the Far East helps to more than offset the potential loss in vessel demand driven by the OPEC+ curbs.

Another market driver that we must highlight is China. Whilst it is difficult to ignore the noises of a bleaker economic outlook, oil demand continues to grow, nonetheless, and monthly crude imports reached new records in 2023. The country’s economy is transitioning away from being based on manufacturing and construction. Instead, China is expanding its petrochemical capacity, aiming for greater self-sufficiency in feedstocks such as LPG, ethane, and naphtha, which now drive demand more than the traditional gasoline, jet, diesel, and gasoil. China’s oil demand is set to continue to expand in 2024 and the country is the main contributor to global growth next year.

Finally, we always need to factor in the bigger picture: the global economy. So, whilst VLCC fundamentals and the wider tanker markets look bullish, the macroeconomic picture is far less certain. Beyond geopolitical conflicts, the hot topics remain energy prices, inflation, and national debt. Most importantly for the shipping markets, a lot of nations continue to teeter on the edge of recession. Historically, the impact of a recession on oil demand varies widely from one crisis to another, with the Covid years being the worst in recent memory. Nobody knows the exact impact of a potential global recession, but it appears that the VLCC market is reasonably well-equipped to deal with one.

As we look ahead to 2024, the tanker markets are lined up with strong fundamentals. Demand continues to grow, even if at slightly more muted rates, but there is a geographical mismatch between oil demand and supply growth. This will continue to drive tonnemiles and therefore VLCC demand up. We expect much of the same as we have seen this year, with a strong upside potential supported by zero to negative supply growth.