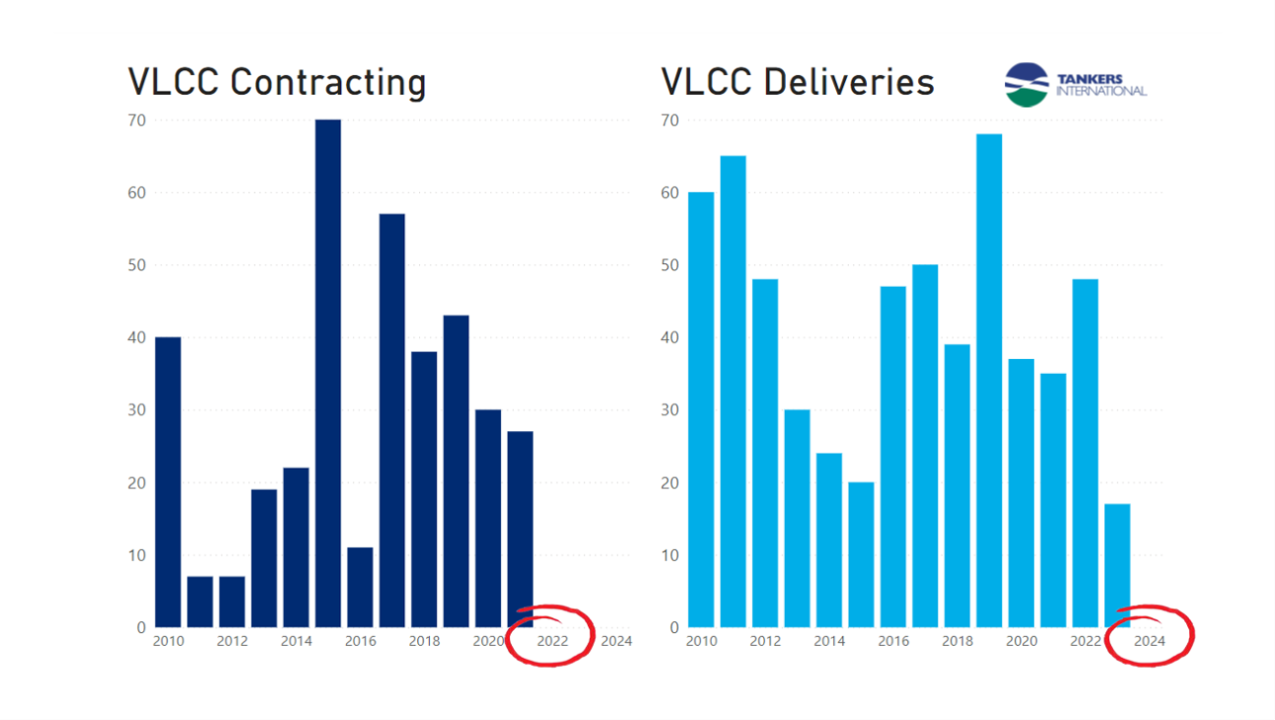

For the past 12 months, we have seen zero new orders for VLCC newbuildings. This has left the orderbook at historically low levels and market fundamentals are pointing to several years of record low fleet growth – or even fleet contraction.

The last recorded order for new VLCC tonnage in the Tankers International Database is dated June 2021. This is more than 12 months ago and this is the result of depressed freight markets combined with booming returns in competing shipping segments. While tanker owners have been struggling with marginal profits since Covid-19 devastated the global demand for oil, shipowners in other segments have experienced golden years, earning healthy returns and leaving them with an appetite for contracting more tonnage. Shipyards have been quick to reach capacity building vessels such as bulk carriers and container ships, and we are currently looking at a delivery timeframe of 2025 or even 2026 to build a large vessel of VLCC dimensions. At the same time, limited yard availability has allowed shipbuilders to push prices up to $120 million to build a new VLCC, and the market has not experienced price levels like this since the tanker ordering boom in 2008.

Therefore, we have a clear view of any new tonnage that will join the VLCC fleet over the medium term. Compared to historical data, the numbers are very low. By our estimation, we expect a further 20 new VLCCs to join the fleet this year, followed by another 15-20 during the whole of 2023. And that is it. No VLCC deliveries are scheduled beyond 2023.

On the flip side, the VLCC fleet is ageing, and there is scope for a significant removal programme. 20% of the current fleet is aged 15 years and older, with 10% of vessels falling into the 18+ years age category. Even if a fraction of this pool of ships is sold for removal, we will see the VLCC fleet reducing in size over the coming years. For comparison, over the last 20 years, an average of 4% of the VLCC fleet has been removed per year. A fleet contraction will be welcomed by tankers owners in a market that has been dominated by tonnage overcapacity for a number of years.

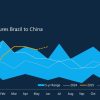

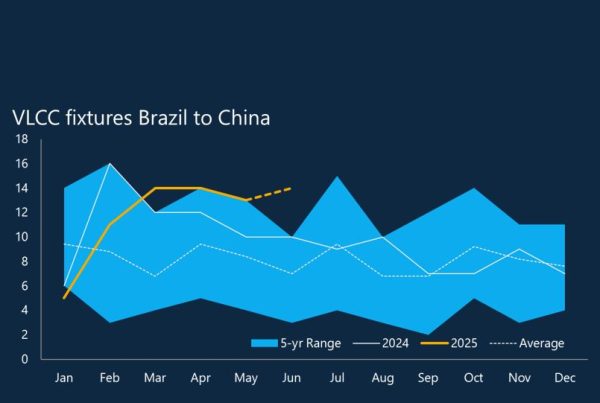

While tanker demand is rising, as Covid-constricted oil demand is in recovery mode, there is still a way to go before there is total balance in the VLCC market. A reduction in fleet supply would get us to a fundamental equilibrium between demand and supply just a little bit quicker.