The world’s leading VLCC pool continues to grow its fleet with 20 new additions since the beginning of 2022.

London, 27th April 2023 – The leading large crude tanker pool, Tankers International, today announced the appointment of Charlie Grey as Chief Executive Officer, replacing CEO Jonathan Lee, who will become Chairman of the board of directors. Grey, who will move from his current role as Chief Operating Officer, will lead the independent organisation through its current phase of growth. Matt Smith will take up the role of COO and will continue to focus on developing voyage optimisation schemes to reduce emissions and improve performance.

Grey officially began his CEO tenure on 3 April and has played a pivotal role to date, alongside the existing board, in expanding Tankers International’s pool of Very Large Crude Carriers (VLCCs). The pool holds 64 vessels today, including an expansion of its specialist scrubber pool from 17 to 34 vessels compared to the start of 2022.

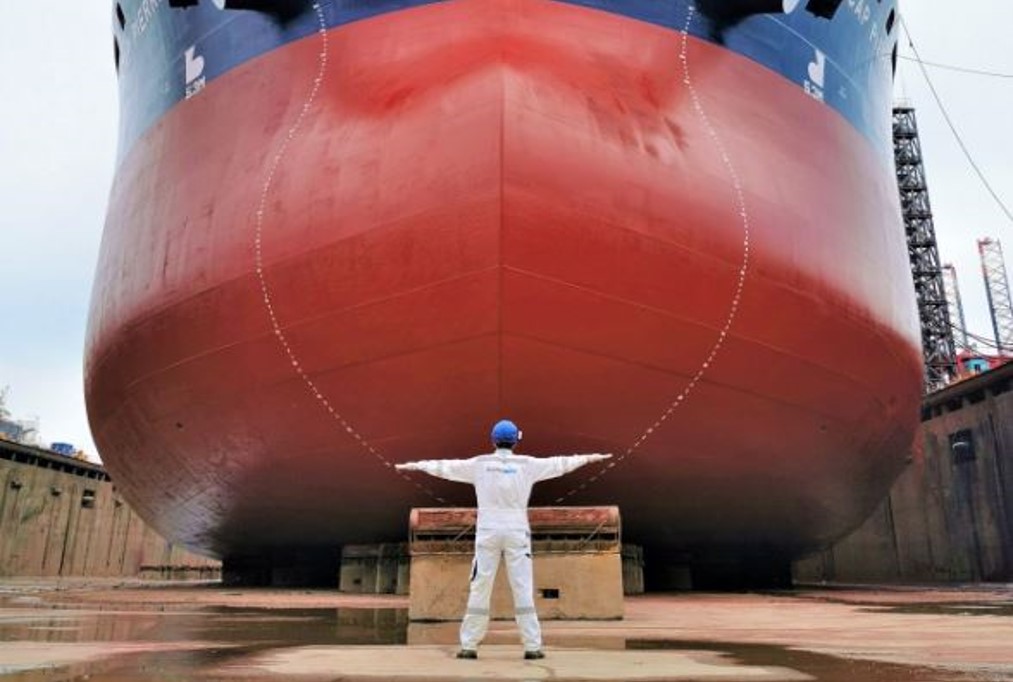

Ensuring a young average vessel age in the pool will be crucial as shipping rides the macro-economic waves, so Tankers International has replaced old and less efficient vessels with modern and energy friendly tonnage. The average age of the pool today is younger than it was at the start of 2022.

Pools have a critical role to play in the safe and transparent transportation of crude across the globe. This is especially true in a highly fragmented VLCC sector. Facing the twin challenges of the energy transition and increasing environmental regulation – shipping pools can allow smaller owners to collaborate more effectively and deliver a more efficient tanker market for all participants.

Tankers International was established in 2000 by a visionary group of tanker owners comprising, amongst others, Euronav NV and International Seaways, inc. VLCC owners who join pools amidst volatile market conditions benefit from improved cashflow and revenues thanks to proven economies of scale, access to a wider customer base, increased financial performance, fairer charter party terms, access to market intelligence and an independent and transparent management service.

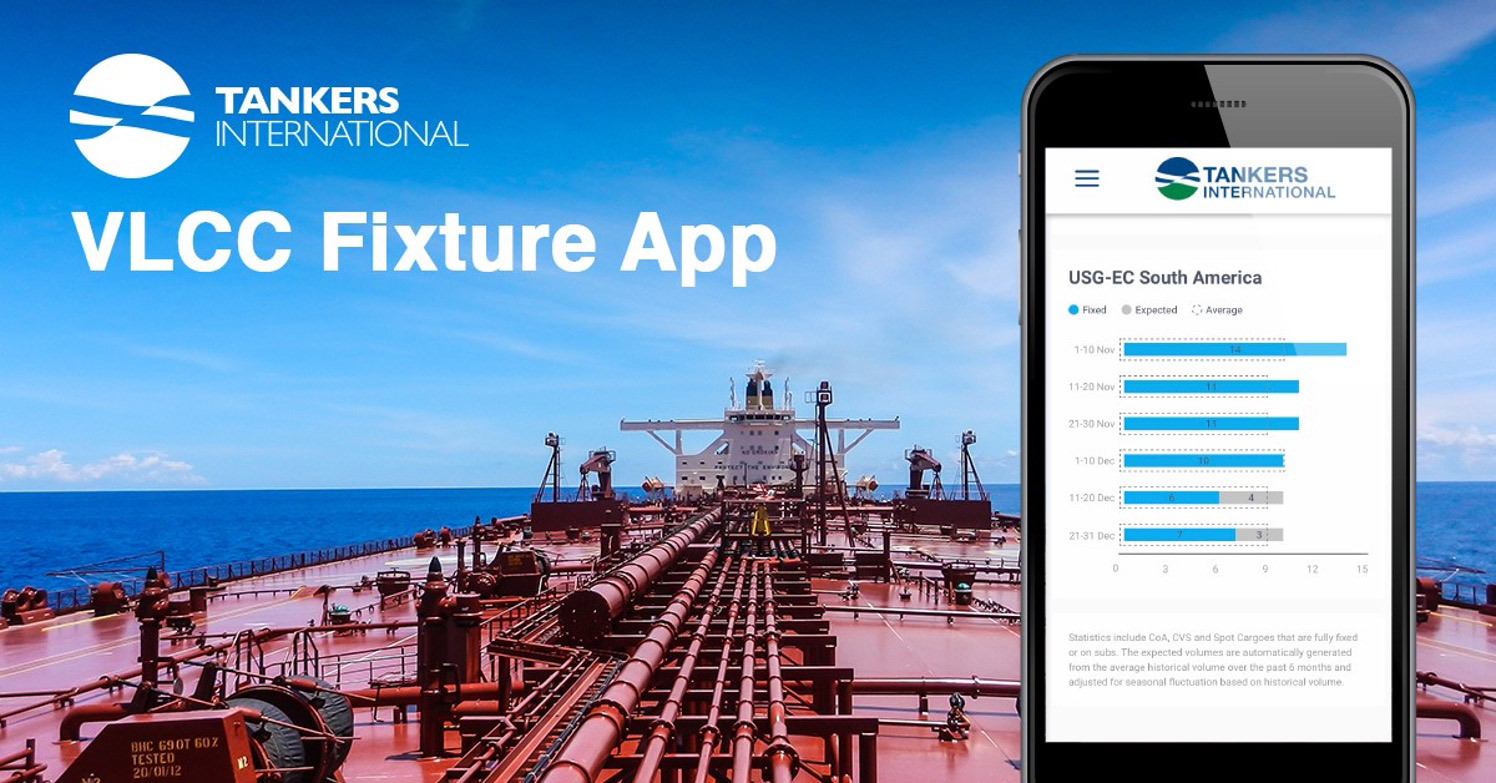

The pool has vastly improved in recent years, with its unique revenue sharing methodology and its strength in scale, data, and expertise helping to drive exceptional revenues for participants. Recent developments include the establishment of a new optional climate compensation voyage programme and the continued development of the widely used Tankers International VLCC fixture app.

Charlie Grey, CEO of Tankers International, commented: “I want to thank Jonathan for the fantastic work he’s delivered over the past 10 years, which has ensured that Tankers International has maintained and grown its market-leading position. I am honoured to be able to take the organisation forward, delivering value to the pool partners, expanding our fleet, and continuing to deliver our data-led, analysis-based approach with a human touch; a formula that has served us – and our pool partners – so well.”

Lois K. Zabrocky, International Seaways Inc.’s President and CEO, commented: “Since he was appointed as COO, Charlie excelled at meeting the needs of pool partners while navigating the uncertain trends driving the VLCC market. I am personally confident that Charlie is the right person to build on Jonathan’s great work to position Tankers International for the future.”

“As a founding member over 23 years ago, we have sought the best stewardship for the leading VLCC pool,” Hugo De Stoop, CEO of Euronav NV, added. “I am confident that under his leadership, along with the support of the management team, Charlie can deliver exceptional value and competitive financial returns for all pool partners.”

Jonathan Lee, outgoing CEO of Tankers International, added: “I believe that we have built something incredible at Tankers International, and I’m very proud to have played my part in building an evolutionary new model for tanker pooling, uniquely positioned to tackle the challenges and maximise the opportunities facing VLCC owners and operators. Since Charlie joined, it has been clear to me that he is the optimal choice to lead Tankers International as it continues to grow and evolve; I look forward to supporting him.”