If you put your tankers in a pool, it can help you navigate CII, such as from making sure any vessels under risk of being downgraded are kept away from potentially CII damaging charterers, and managing the CII data. Charlie Grey of pool operator Tankers International explains.

CII will push VLCC owners into new territory as they tackle shipping’s first true decarbonisation regulation. Arguments between shipowners and their charterers are simmering with BIMCO caught in crossfire. Regardless, CII is here now, and tanker shipping needs to comply. But how? CII represents the first global carbon emissions regulations applied to the international shipping fleet – something the industry needs to implement if shipping stands a chance at hitting the IMO’s emissions targets.

Yet, CII is not perfect and has several well-documented flaws.

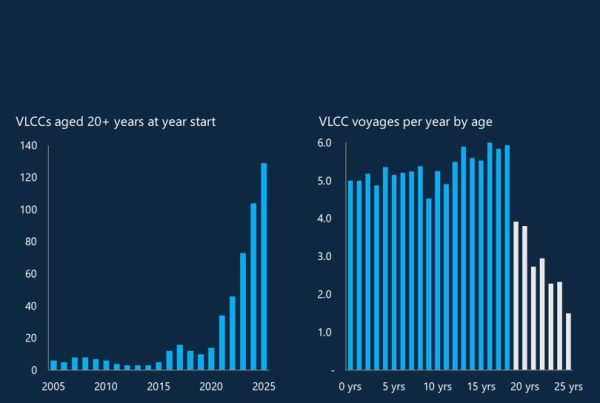

For instance, while installing low-carbon technologies will make a passing grade easier, a highly efficient vessel will not necessarily have a good rating. A highly efficient vessel that sits at anchor for several days will require bunker fuel to power its generators, emitting CO2 yet travelling no distance. This means that an idle, efficient ship may have a worse score than an older, less efficient, but highly utilised ship. VLCC owners have to tackle a difficult trade-off between CII ratings and commercial performance. CII-negative voyages may represent commercial benefits, while CII-specific contractual clauses may be considered negotiable by charterers.

CII concerns add a new dynamic to data analysis. Shipowners now need to consider their vessel’s potential voyage impact on CII ratings alongside, regional pricing, and supply and demand side market trends in actionable analysis. Whilst this entered into force from 1 January 2023, CII scores will not be published next to vessels until January 2024. At the same time, those scores will be out of date for 364 days every year and will only reflect an average up until the end of the last reporting period. This lack of data means that vessels with falling ratings will not see that reflected in their score for some time, while vessels with improving ratings will not have that reflected in their grade until the start of the next calendar year. These inconsistencies limit CII’s usefulness for charterers as an indication of the efficiency of a vessel.

Shipowners and operators are forced to find the right balance between some lucrative CII-negative fixtures and CII-positive voyages, and between cash flow and efficiency technologies. This can create a trade-off between CII scores and short-term profitability for any ship. Shipowners must understand how to operate and trade their ships to tackle this anomaly and achieve a good CII rating; ensuring that they incorporate these requirements into charter party agreements. They must adaptively manage their vessels speeds and idle days throughout the year, ensuring that vessels average a passing grade whilst maximising profits. This adds another layer of complexity for shipowners. CII represents another stream of data that must be analysed and converted into insights and actions.

Pool participation

The volume of ships in a pool allows shipowners and operators to benefit from greater economies of scale, financial robustness and flexibility through greater utilisation across their fleets, helping them to mitigate any impact on CII ratings.

Pool partners can take profitable CII-negative fixtures while maintaining ratings across the fleet by spreading those voyages across the pool based on CII scores to date. By doing so, the collective pool of ships can maximise earnings while the pain of CII-negative voyages is minimised for any individual vessel.

The pool simplifies a shipowner’s role, providing regular cash flow based on their vessel’s earning potential in the current market conditions and reducing the need for operational staff. Shipowners can allocate this resource elsewhere, including evaluating and implementing low or no-carbon technology across their fleet.

Another issue is that cash flow can effectively bar small or cash-poor shipowners outside of a pool from longer routes, which are often the most profitable. This is because the shipowner must pay for bunkers before they receive freight payment from a charterer. These routes are inherently CII-positive, as they maximise constant-speed travel and minimise time at anchor. This challenge is something that Tankers International is acutely aware of and can compensate for with the size and structure of its pool.

Tankers International has included indicative voyage CII scores in its Tankers International VLCC Fixture app, showing an estimated letter grade rating and comprehensive calculation for every VLCC voyage fixed.

Published in Tanker Operator in May 2023: LINK