The global oil markets have entered 2022 with a sense of optimism. Where the new COVID-19 omicron variant momentarily threatened to stall any progress achieved through the summer and autumn months of last year, it appears to present less of a risk to market recovery than initially feared – and oil market reporting agencies continue to forecast demand recovery in 2022.

Many of these agencies are now predicting that demand levels will return to pre-COVID highs. The most recent indications from Platts Analytics point to an additional 4.6 million barrels per day of demand in 2022, hitting 103 million barrels per day, which is 0.4% above pre-pandemic levels.

Global oil supply is also rising strongly and, after a 1.6 million barrels per day increase in 2021, global supply growth is set to accelerate this year to 6.6 million barrels per day. While we see positive supply projections from places like the US, Canada and Norway, it is still thought that a strong call on OPEC will remain. This will push Saudi Arabian supply even higher than it currently is, according to Platts Analytics, and we could see volumes close to their official capacity levels of 11.5 million barrels per day.

Any growth in oil volumes traded is positive for the oil tanker sector, and historically there is a strong correlation between OPEC production and the demand for large crude carriers, in particular for VLCCs.

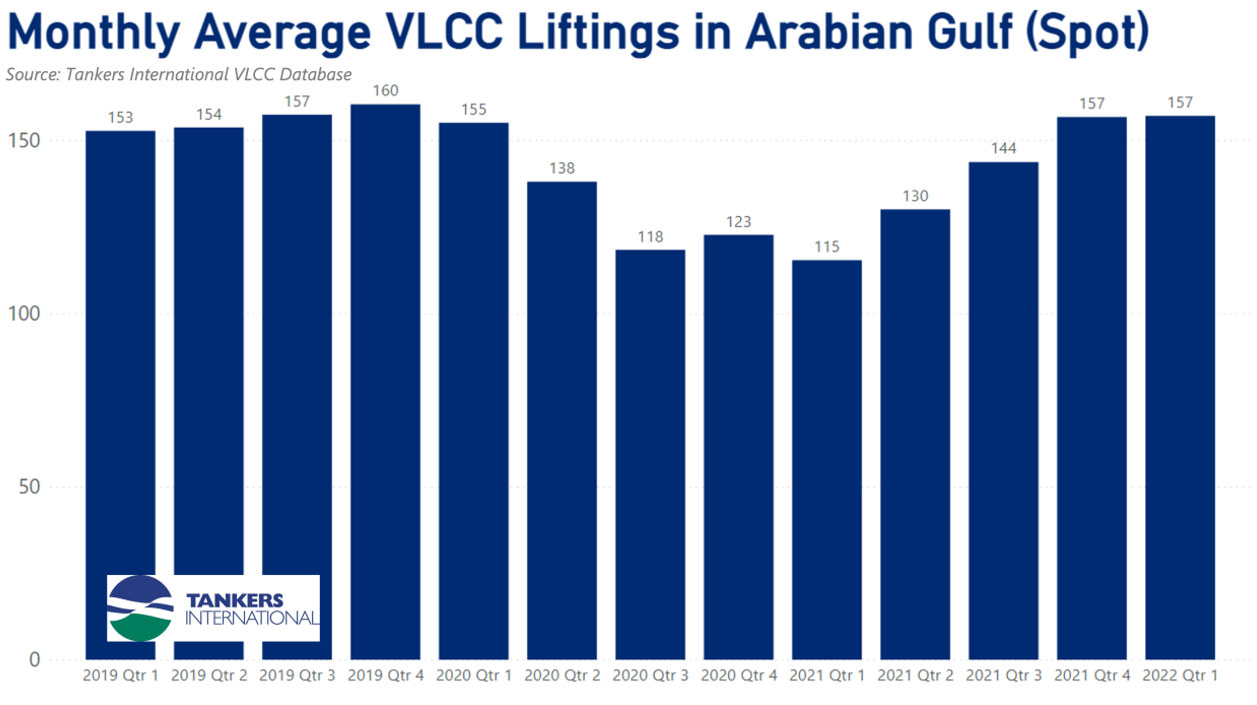

The VLCC market has already seen demand increase in the Middle East; towards the end of last year the number of spot market cargoes lifted in the Arabian Gulf reached a similar level to those experienced in 2019, before the COVID-19 pandemic.

In 4Q 2021 we counted an average of 157 VLCC spot cargoes lifted in the region per month. This trend looks set to continue into this year. In January we have also counted 157 VLCC liftings in the Arabian Gulf and on the Tankers International VLCC Fixture App we note that fixtures are surpassing the expected numbers for the month.

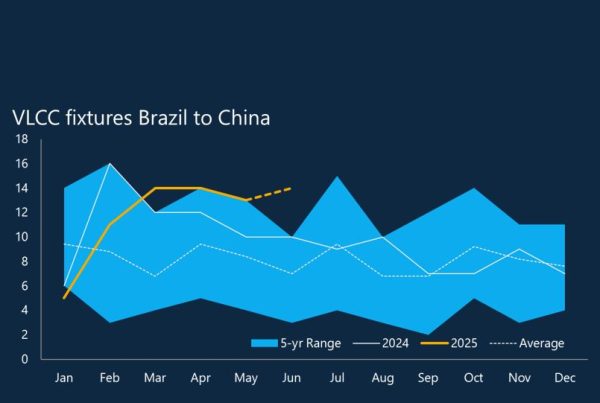

With oil production projected to ramp up through the course of 2022 we expect to see further expansions in tanker demand, not only in the Arabian Gulf but globally. Preliminary data (available via the Tankers International VLCC Fixture App) shows that the lifting programme in West Africa is also larger than expected in January and the same is the case for the US Gulf and South America region.

While the Arabian Gulf volumes are important to the VLCC market and a very good indicator of the general health of vessel demand, crude oil shipped from the Atlantic Basin tends to carry greater tonne miles, employ vessels for longer periods and ultimately reduce tonnage availability across the globe.

The VLCC market is moving towards an equilibrium where demand is closing in on supply, thereby reducing tonnage availability per cargo which should in turn translate into better freight rates.