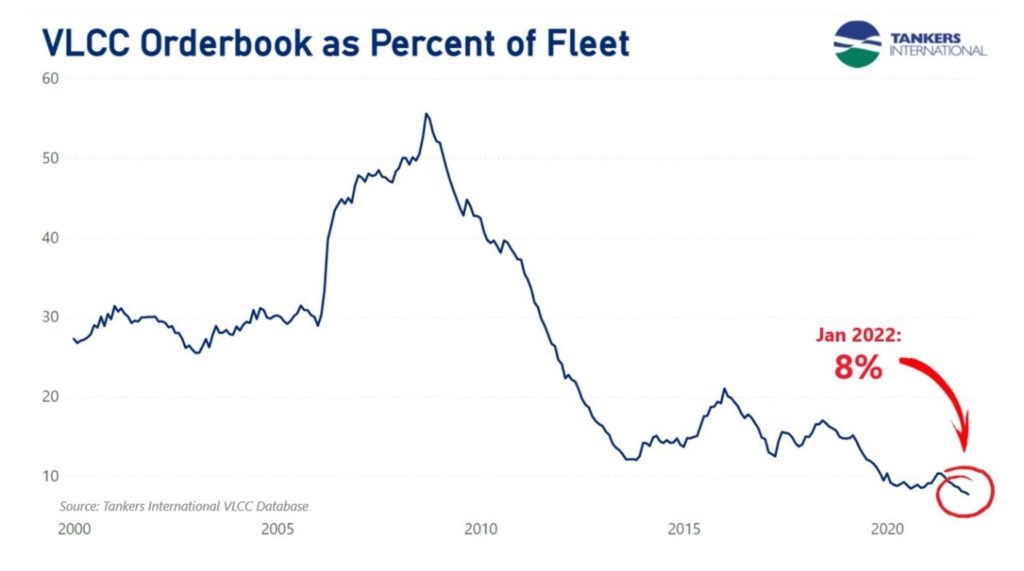

The VLCC orderbook is at a historically low level, with the segment making up just 8% of the global trading fleet. This metric supports our positive freight market outlook for 2022. With many shipyards reporting limited availability in the next couple of years, it is unlikely that many new VLCC orders will be placed for delivery in 2022-2024. This means we have a good grasp of expected fleet additions for this time frame.

The VLCC orderbook is shrinking on the back of a slowdown in tanker contracting. This is driven by several factors. The oil tanker sector has gone through a period of very low earnings. Most VLCC owners have been far from breaking even on most of their vessels, making it difficult to justify investing in new tonnage. Secondly, the shortage of large vessel slots in reputable yards has pushed prices up. An earnings boom in the container and dry bulk sectors has encouraged contracting in these segments, filling up yard capacity fast. Another driving force is the uncertainty around the longevity of any engine design decisions made today and how to ensure newbuilt vessels will successfully navigate a low-carbon future.

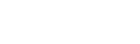

With low fleet growth expected over the next few years the VLCC market is moving closer to an equilibrium between vessel supply and demand. Vessel demand has already started to see signs of a sustained recovery. The demand for oil is picking up across the world and OPEC and its allies are determined to maintain their original schedule of incremental monthly oil production increases.

As more oil is moved around the globe, the demand for oil tankers will benefit. We are optimistic about 2022 and believe that this is the year we will see a positive shift in the VLCC freight market.