How the

pools work

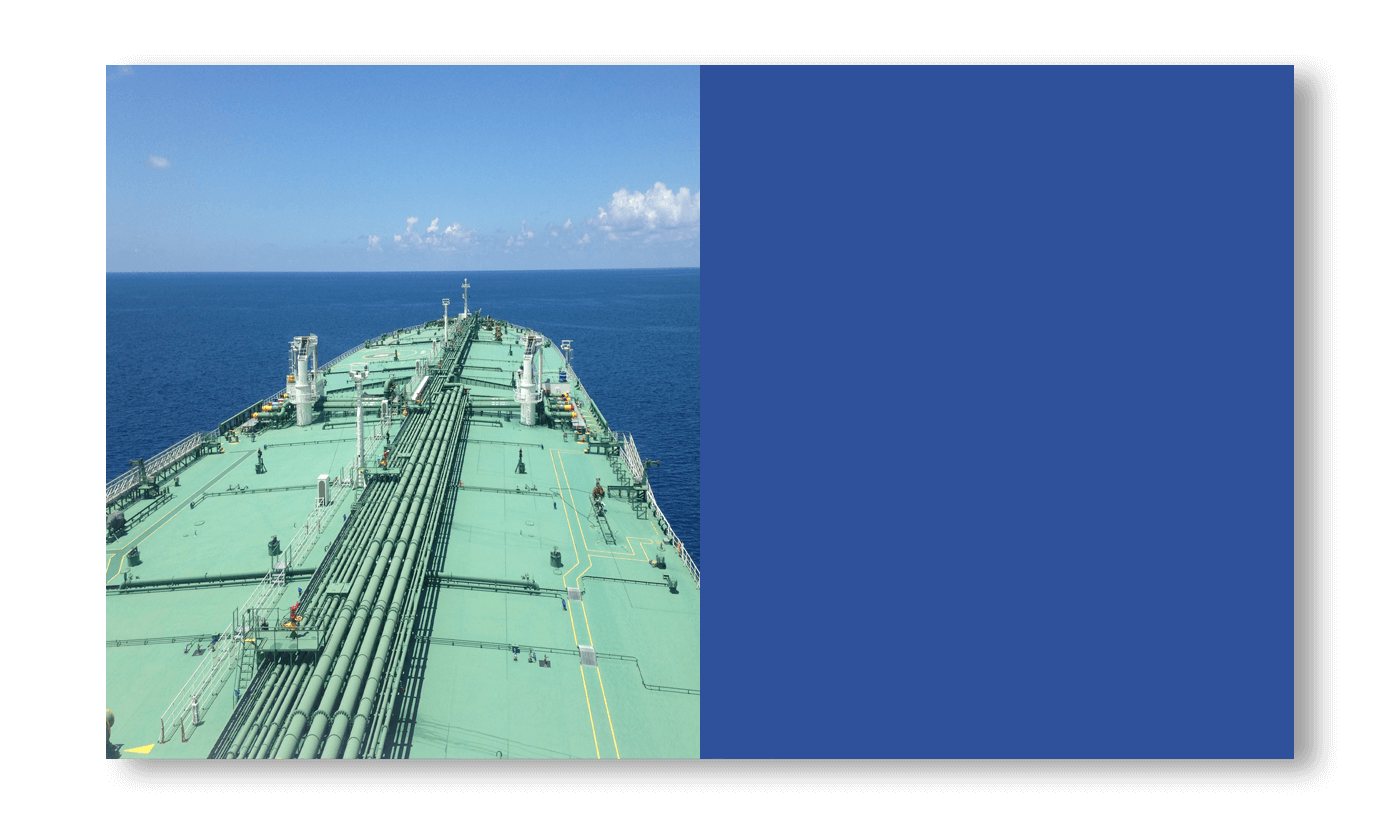

The Tankers International Pools provide a physical hedge for Owners by ensuring stable and regular cash flow during volatile market conditions whilst still being able to take advantage of market upsides. Earnings are typically distributed to Participants twice per month, depending on market conditions and working capital requirements across the fleet.

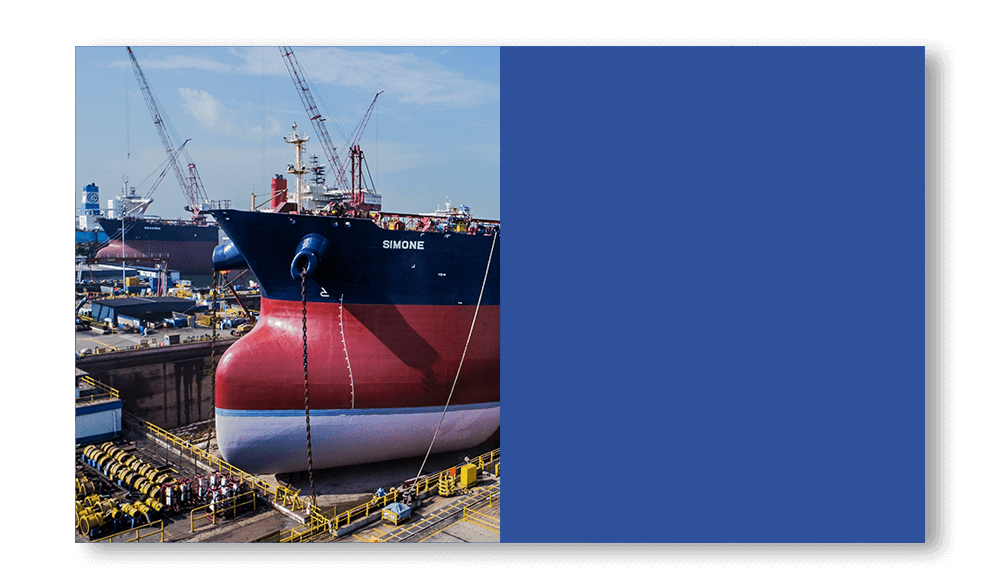

We always welcome new participants with top-quality ships and who adhere to the high standards of ship management we expect.

Pool Participants undertake to trade their qualifying vessels in the Tankers International Pools and receive a share of the freights in accordance with the Pool Points allotted to each of their vessels. All commercial decisions are handled by the Pools’ commercial team with the exception of any specific trading restrictions which Owners may stipulate.

A vessel’s share of the total Pool income is determined by its theoretical earnings potential relative to the rest of the fleet and is illustrated by its allocated ‘Pool Point’. The Pool Point system is highly transparent based on vessel specific data and market data combined with a standardized calculation method, which is openly shared with all participants. Pool Points are adjusted every six months to reflect changes to trading patterns, fleet composition, market level and bunker prices to ensure overall weighting remains fair.

Reporting of commercial and financial results is done via access to an extranet with weekly, monthly, quarterly and annual reports. These reports are prepared with the objective of producing informative reports in a timely manner.

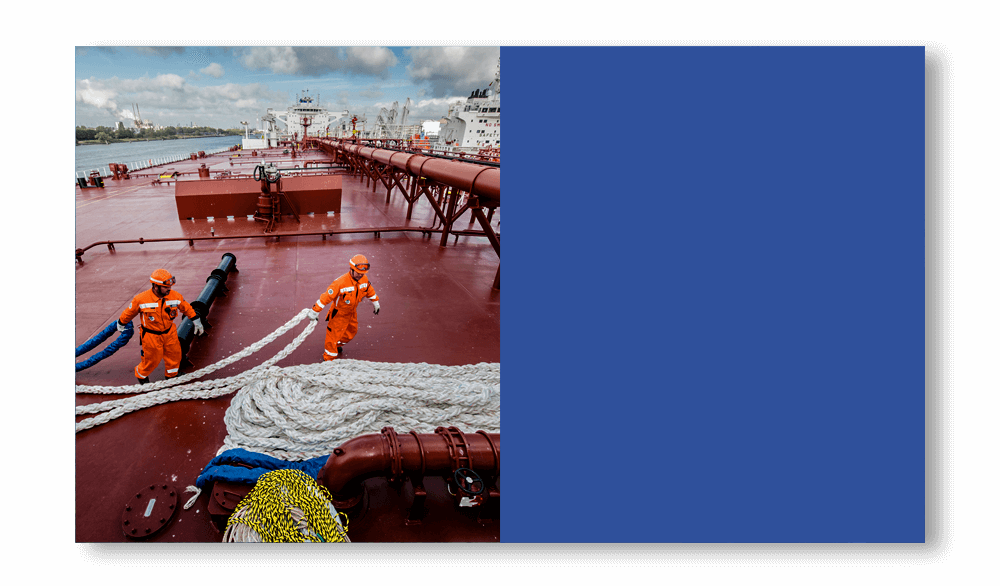

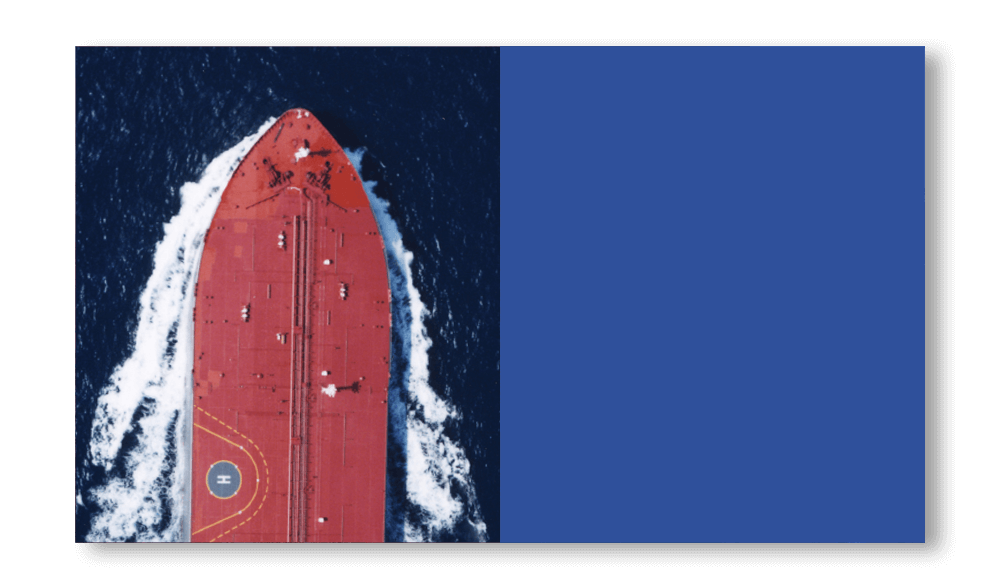

Tankers International employs motivated, professional people at all levels. We have offices in London, New York and Singapore to ensure global coverage for our Participants as well as for our Customers.