Geopolitics and supply shifts drive sustained VLCC demand from Brazil to China

The combination of rising Brazilian crude supply, shifting geopolitical dynamics, and price-sensitive Chinese refinery demand has led to a significant increase in VLCC shipments from Brazil to China in recent months.

Several new FPSOs (Floating Production Storage and Offloading units) came online at the end of 2024, enabling Brazil to steadily ramp up its crude oil production and exports in early 2025. According to data from Vortexa, Brazilian crude exports rebounded sharply in March to nearly 2 million barrels per day (mbd), after hitting a seasonal low of just 1.3 mbd in January.

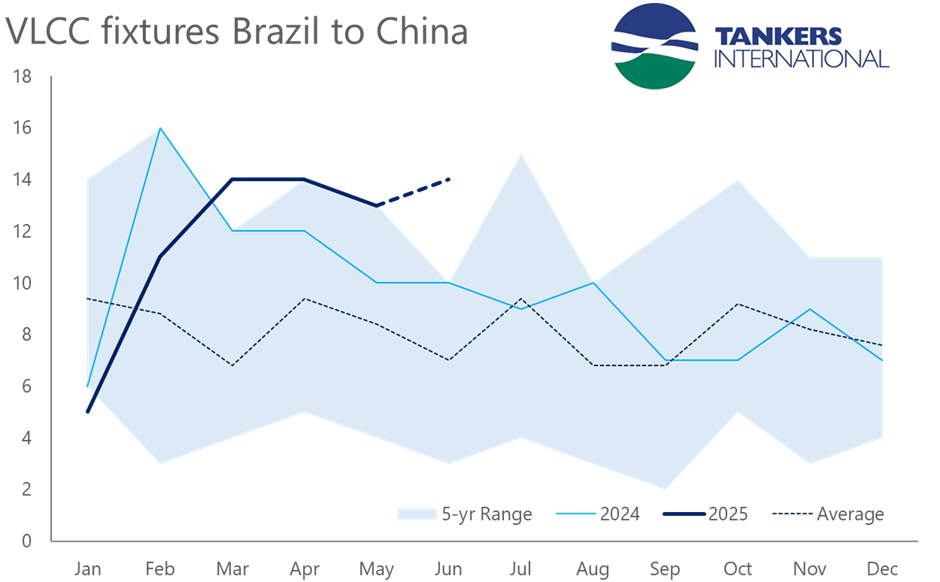

Our proprietary fixture data reflects the rebound. VLCC liftings from Brazil to China have increased steadily this year – from just five in January to 14 in March – with this elevated activity sustained through April and May. This follows a downward trending VLCC cargo count throughout most of 2024, on the back of Chinese refiners buying more sanctioned Iranian oil and using dark fleet vessels to transport these barrels, diverting demand away from mainstream markets.

Several market forces are contributing to the recent upward trend. One key driver is the tightening of US sanctions targeting the dark fleet tankers linked to Iranian and Russian trades, as well as “teapot” refineries that have traditionally imported discounted sanctioned crude. With these low-cost barrels no longer accessible without the risk of facing a penalty, some refineries have turned to alternative mainstream sources. Brazil is a natural candidate.

Adding to the momentum, China’s 10% retaliatory tariffs on US crude imports continue to make American barrels uneconomical for Chinese buyers.

In March, Saudi Arabia raised its official selling prices to Asia, further straining the budgets of price-sensitive refiners and encouraging a shift to more affordable Atlantic Basin grades. Brazil’s growing export availability met that demand at the right time.

While a round voyage from the Middle East to China typically takes around 60 days, the Brazil to China roundtrip could take 100 days and more. This longer sailing duration locks in vessels for extended periods, tightening available tonnage and lending support to VLCC freight rates. As more ships are committed to the Brazil to China route, the knock-on effect benefits the wider VLCC market.

Looking ahead, the outlook remains positive for VLCCs. While OPEC+ may gradually ease production cuts and Asian buyers could resume more purchases from the Middle East, so far as we enter June, our fixture data already shows that at least 14 cargos are scheduled to be loaded from Brazil to China in June if they discharge as reported. If Brazil continues expanding its crude production, we expect the Brazil to China VLCC flow to remain strong, providing continued support and demand for VLCCs in the months to come.

Data Source: Tankers International VLCC Database

Read our Data Spotlight on historical VLCC liftings in Brazil HERE.