It’s clear that trading patterns for VLCCs have changed significantly over the last 12 months. European oil markets have seen a clear shift away from Russian crude since the start of the Russia-Ukraine conflict.

Official sanctions by the EU on Russian crude in place today mean that we now see virtually no Russian crude flowing into Europe and other Western economies. In June 2022, the EU Council adopted a sixth package of sanctions that, amongst others, prohibited the purchase, import or transfer of seaborne crude oil and certain petroleum products from Russia into the EU. The restrictions applied from 5 December 2022 for crude oil and from 5 February 2023 for refined petroleum products.

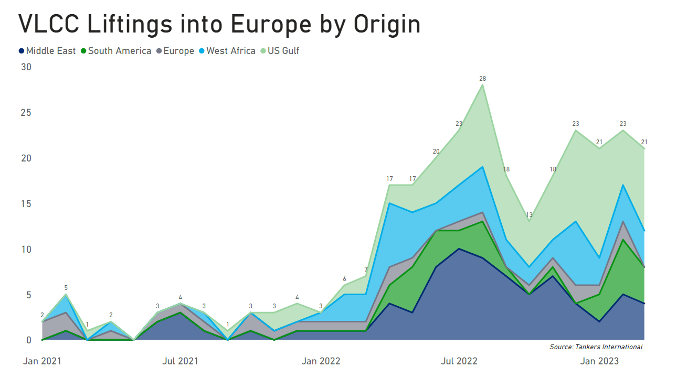

Europe has therefore had to find alternative crude supplies from other sources. We have seen Europe increase its imports from the Middle East, as well as Atlantic based oil suppliers including West Africa, the US and South America.

Smaller tankers have traditionally serviced the routes from these Atlantic basin suppliers to Europe, but in 2022 we saw a marked increase in the use of VLCCs. There were 28 VLCC loadings destined for Europe in August alone. This compares to just 1-4 monthly liftings prior to restrictions on Russian barrels.

Several market factors have aided this development. Firstly, we have simply seen more seaborne oil imports into Europe as Russia’s pipeline network and short haul shuttle shipments were no longer an option.

While the smaller tanker segments – Suezmax and Aframax – saw freight rate spikes in the immediate aftermath of the war breaking out, the VLCC segment had no direct links to Russia, so the freight environment for this group of ships remained flat and relatively low. This relatively weak VLCC freight market allowed VLCCs to compete with the smaller segments on the inter-Atlantic routes that in the past they had zero involvement in.

From the second quarter of 2022 onwards, we saw a sharp rise in inter-Atlantic VLCC liftings, and this elevated level of activity has persisted since. Our proprietary fixture app data does show a short-lived dip in VLCC activity in September and October last year. This was partly due to a drop in crude flows into Europe, according to data from Kpler. This was also the time when the VLCC freight market began its strong recovery, and we saw a proportional increase in the use of smaller tankers compared to the record month of August for the VLCC segment.

Since then, it appears that the inter-Atlantic trade routes have found a new balance and that they are here to stay. The use of VLCC tonnage has increased to 21-23 liftings per month over the last four months.

This trend is a positive development for shipowners. It allows vessel owners to keep their ships in short-haul business in a relatively high market and to be able to load another cargo while freight is high. This can be more lucrative than locking the vessel in on a long-haul trade and risking that the market may have fallen by the time of the next load.

This dynamic creates more volatility in the market with uncertainties around discharge times and with more frequent port operations that shorter voyages inherently carry. The result is the port to sailing time ratio goes up. This new dynamic also allows for increasingly creative trade combinations, and by triangulating a vessel, a shipowner can maximise their earnings compared to a standard Middle East to China trade route, which carries an equal amount of laden to ballast days.

On 25 February 2023 the EU adopted its 10th package of sanctions against Russia and is expected to announce more new sanctions in the coming weeks. We continue to monitor the situation, but we expect the current VLCC market conditions to persist throughout 2023, and beyond.