As the first half of 2024 draws to a close, the VLCC market presents a picture of moderate improvement without the dramatic boom witnessed in other tanker segments. While freight rates have exhibited a steadier trajectory compared to the volatility of 2023, peak levels haven’t quite reached the heights anticipated. But at the same time, the lows haven’t dipped as drastically either. That being said, all the right factors are in place, and the VLCC segment taking part in the super cycle is a question of when, not if.

Fundamentals

The underlying fundamentals supporting the VLCC market remain largely unchanged since the beginning of the year. The key driver continues to be a lack of fleet renewal, with minimal new deliveries offset by a significant number of vessels exceeding their traditional 20-year lifespan. Scrapping activity and other forms of vessel retirement have remained subdued due to a period of relatively strong returns and optimistic market outlooks. Additionally, the growth of the “dark fleet” persists, providing an alternative outlet for these older ships. Comparing an orderbook-to-fleet ratio of just 7% to an older fleet representing 21% of the trading fleet, the fleet profile is supportive of a tightening tonnage balance.

The recent effective closure of the Suez Canal and the wider Red Sea area, which significantly impacted product tanker markets, has had a relatively muted effect on the VLCC sector. The inherent nature of the VLCC market, where historically only a limited number of vessels utilise the Suez Canal, has meant limited disruption to the segment and a mere 4 VLCCs equivalent increase in demand due to the rerouting. This is where the product tanker segment has found surging support over the past 6 months.

The ongoing Russia-Ukraine conflict continues to play a crucial role in shaping all tanker markets, including VLCCs. Russian oil continues to be diverted to buyers outside Europe, prompting Europe to source supplies from alternative sources like the US, West Africa, and the Middle East. This dynamic translates into more inter-Atlantic trading, where VLCCs become competitive when freight economics permit. This does not necessarily mean longer tonne miles, but these routes provide access to more creative trading opportunities and allow owners to triangulate vessels and optimise their fleets.

OPEC+

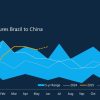

The Middle East to Far East route remains the backbone of the VLCC market. While OPEC+ production cuts have restrained oil flow from the Middle East region, positive signals are on the horizon. Recent announcements from OPEC+ on their production management strategies pointed to a gradual phase-in of previously curbed production volumes starting in October. The group plans to add 2.5 million barrels per day over the following 12 months. This includes bringing back 2.2 million barrels of voluntary cuts and allowing the UAE to raise production by 0.3 million barrels per day. Additionally, the market anticipates a rise in incremental supply from Atlantic basin producers such as the US, Canada, Brazil, and Guyana. As incremental demand is expected to remain concentrated in the East, this scenario translates into long tonne mile demand for VLCCs.

The positive news continues, with forecasting agencies all projecting a rise in oil demand over the year and, in particular, during the second half of 2024 compared to the first. Much of this hinges on China fulfilling the robust demand projections predicted for the nation. China’s leadership has set itself an ambitious economic growth target and is taking proactive measures to achieve this. Historically, this proactive approach is closely linked to growth in oil demand and, importantly for the VLCC segment, a rise in oil imports. Furthermore, the optimistic demand outlook from the forecasting agencies point to growth in the Call-on-OPEC, which aligns with OPEC+ plans for a phased production increase.

The VLCC market has shown resilience in the first half of 2024. While not experiencing the dramatic boom of other tanker segments, it has exhibited steady growth with positive indicators for the remainder of the year. Stronger demand growth, the return of some OPEC+ production and continued geopolitical influences are all factors to monitor as the market navigates the second half of the year. We remain optimistic that the VLCC segment will find its moment to enter the stage and take an active part in this year’s super cycle.