The Atlantic basin has not traditionally been a place where VLCCs pick up crude cargoes destined for Europe. These relatively short haul routes load in North and South America, West Africa and the Mediterranean for discharge in Northern Europe and are usually serviced by smaller oil tankers. This year we have seen VLCCs increasingly competing for this business resulting in a change to trade patterns for the segment. There are a number of factors that help to explain this situation.

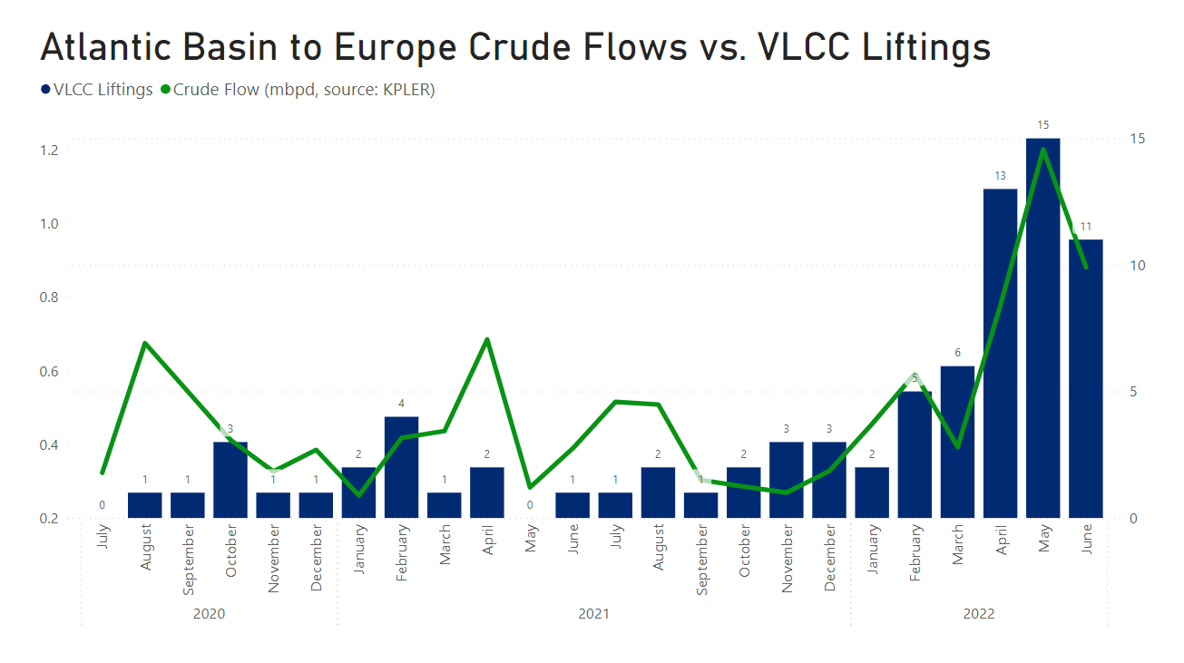

Firstly, oil flows from Atlantic basin producers to Europe has increased. Crude flow data from Kpler clearly shows an increase this year, especially as we move into the second quarter. This of course is on the back of reduced crude flows into Europe from Russia. If we overlay this with Tankers International fixture data we note a sharp rise in VLCC liftings over the same period. In the second quarter of this year, we have counted an average of 13 inter-Atlantic VLCC liftings per month compared to historic figures of just 1-3 monthly liftings.

However, the increase in crude flows does not fully explain what has happened here, as this could have simply translated into a boom in the Suezmax and Aframax segments. This did occur to some extent. As Europe began to replace Russian crude with similar grades from suppliers in the Atlantic basin, freight rates for the smaller tankers spiked as demand went up. A relatively weak VLCC freight market meant that this segment became more competitive, even on these shorter routes, and VLCC fixing activity started to take off.

One question that arises is whether this represents a fundamental change to VLCC trade patterns going forward. The answer to this is not straightforward. If the crude flows into Europe from Atlantic basin suppliers remain at elevated levels, they will certainly provide a baseline for keeping a certain level of localised VLCC activity within the region. The swing factor is likely to be freight markets and the correlation between Suezmax and VLCC freight. Charterers will consider all options and, all other things being equal, choose the cheaper vessel.