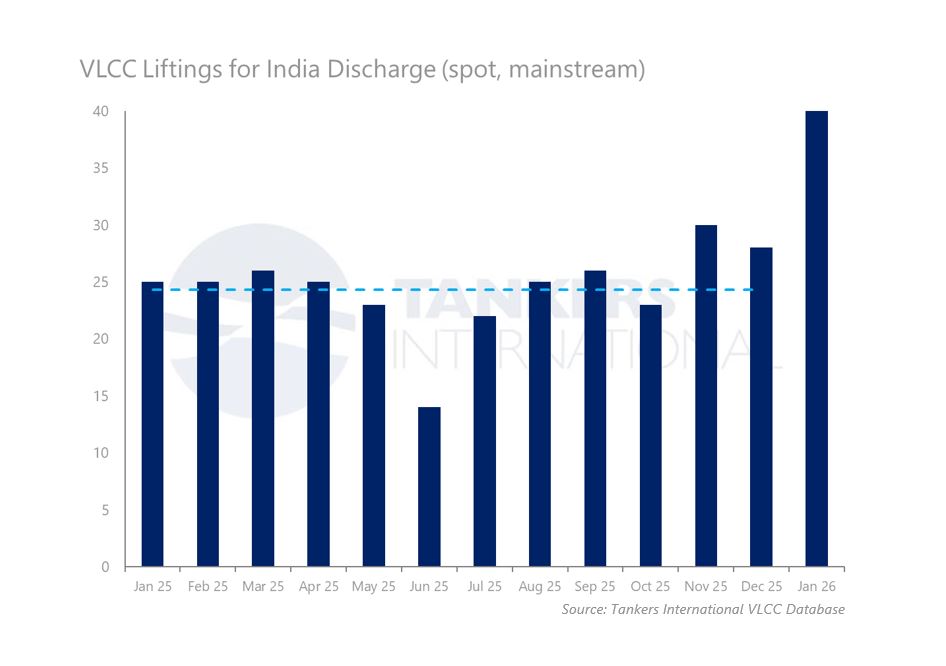

In January, the monthly count of mainstream VLCC liftings for discharge in India rose by 16 compared to the 2025 monthly average. From a baseline of 24 liftings per month, that’s a 67% increase.

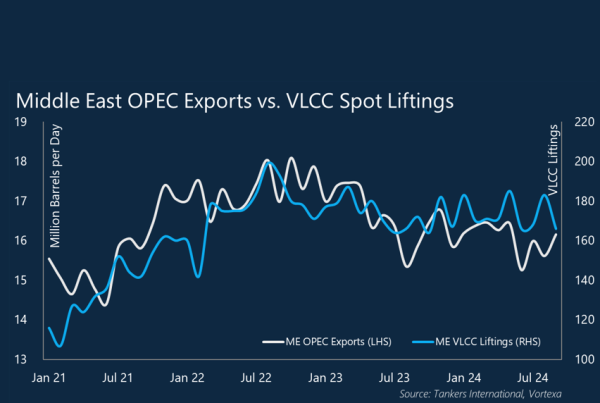

Most of the additional volumes have come from the Middle East, with a visible uptick from South American producers as well. This points to a clear change in India’s crude sourcing – moving away from sanctioned Russian barrels and replacing them with mainstream supply. That direction is consistent with recent press coverage highlighting political pressure on India to reduce purchases from sanctioned producers.

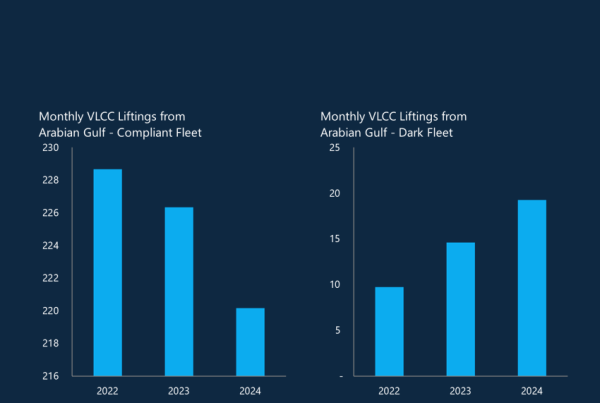

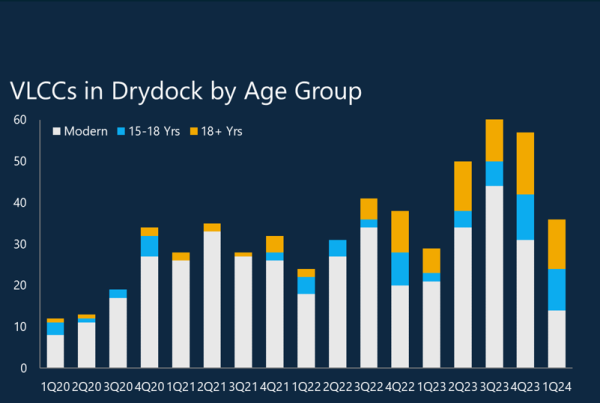

If this trend continues, it could reshape tanker demand. India has been a key buyer of Russian crude, much of it transported on dark fleet tonnage. A sustained shift back to mainstream barrels would support demand for the conventional tanker fleet, at the expense of sanctioned-linked trades.

Interestingly, despite talk of a potential US–India trade pact involving more US and possibly Venezuelan crude, January fixture data shows no VLCC movements into India from either origin.

Is this a structural shift or simply a short-term adjustment? As we continue to monitor fixture flows you can follow these trends yourself, with real-time updates on our VLCC Fixture App: app.tankersinternational.com