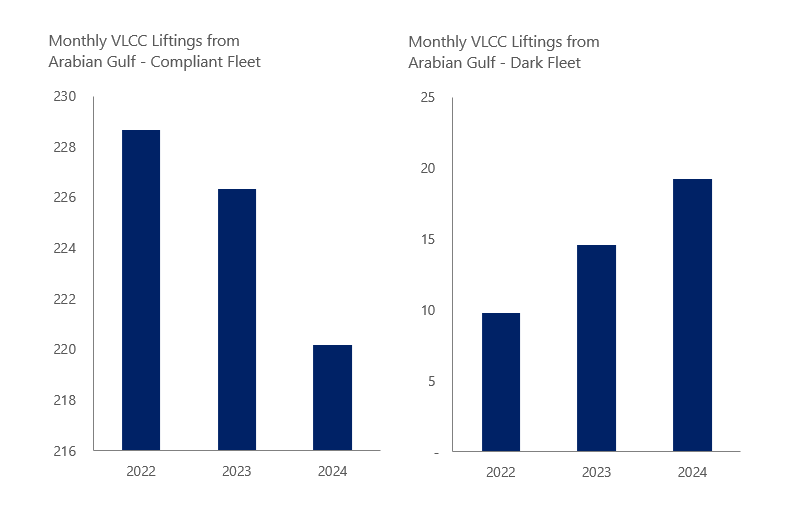

Our proprietary VLCC fixture data clearly reflects the changing nature of Middle East crude exports: a rise in sanctioned oil flows and a corresponding drop in compliant volumes.

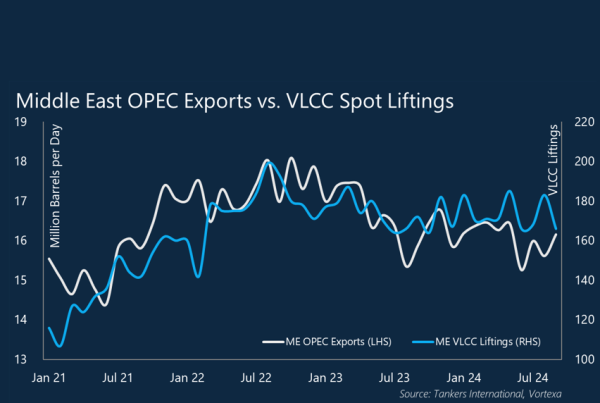

Since 2022, OPEC+ production cuts, driven by non-OPEC supply growth and rising Iranian output, have reshaped the market. In the Middle East, Saudi Arabia, Iraq, the UAE, and Kuwait have reduced exports, while Iran has significantly increased theirs.

This shift has effectively transferred cargoes from the compliant tanker fleet to the “dark fleet”, a trend clearly visible in our VLCC fixture data as seen in these charts. Sanctioned crude liftings now account for 8% of the total VLCC liftings in the Arabian Gulf, double the 4% seen in 2022.

Looking ahead, potential increased US sanctions enforcement on Iran could reverse this trend, tightening compliant VLCC capacity and impacting freight rates. We’re monitoring the situation closely.