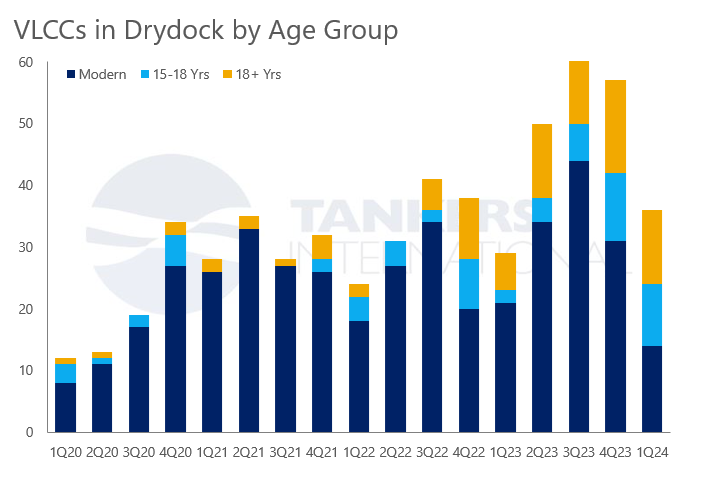

The past couple of years have seen a notable uptick in drydocking activity for older tankers. This trend coincides with the well-documented growth of the shadow fleet, raising questions about safety and environmental compliance. Our proprietary data indicates that in 2023 more than 40 VLCCs aged 18 years and older went through a drydock.

Traditionally, older vessels nearing the end of their operational life would be scrapped for parts or metal. However, the emergence of the shadow fleet, a collection of older tankers operating outside of traditional regulations and oversight, appears to be altering this dynamic.

The increased profitability of operating older tankers, particularly for transporting sanctioned cargoes outside the mainstream tanker market, is incentivising owners to invest in drydocking vessels. The high cost of a drydock is often seen as a precursor to scrapping, but in the current climate, it seems that some owners are opting to extend the life of their assets and capitalise on the shadow market.

This trend presents a unique challenge for the industry. The shadow fleet raises concerns about safety and environmental compliance. Classification societies and regulatory bodies have withdrawn their support for vessels trading in sanctioned trades, as has the insurance community. This means less oversight on maintenance and assurance that minimum operating standards are met.

Part of the trend could, of course, also be explained by the highly positive outlook for the mainstream tanker markets in the next couple of years. We, and many other market stakeholder, are confident that a combination of limited fleet growth and explanding tonnemile demand for large crude tankers will support a healthy freight environment in the medium term, leaving owners to want to hold on to tonnage that might historically be divested.

Looking deeper into the data we do find some mainstream owners drydocking older vessels. However, in the time frame covered, we note that 80% of the vessels that went through a drydock aged 18 and older are being traded in the shadow fleet. This would suggest that the drydocking trend of the older fleet is predominantly driven by the rise in the shadow market.

Source: Tankers International VLCC Database