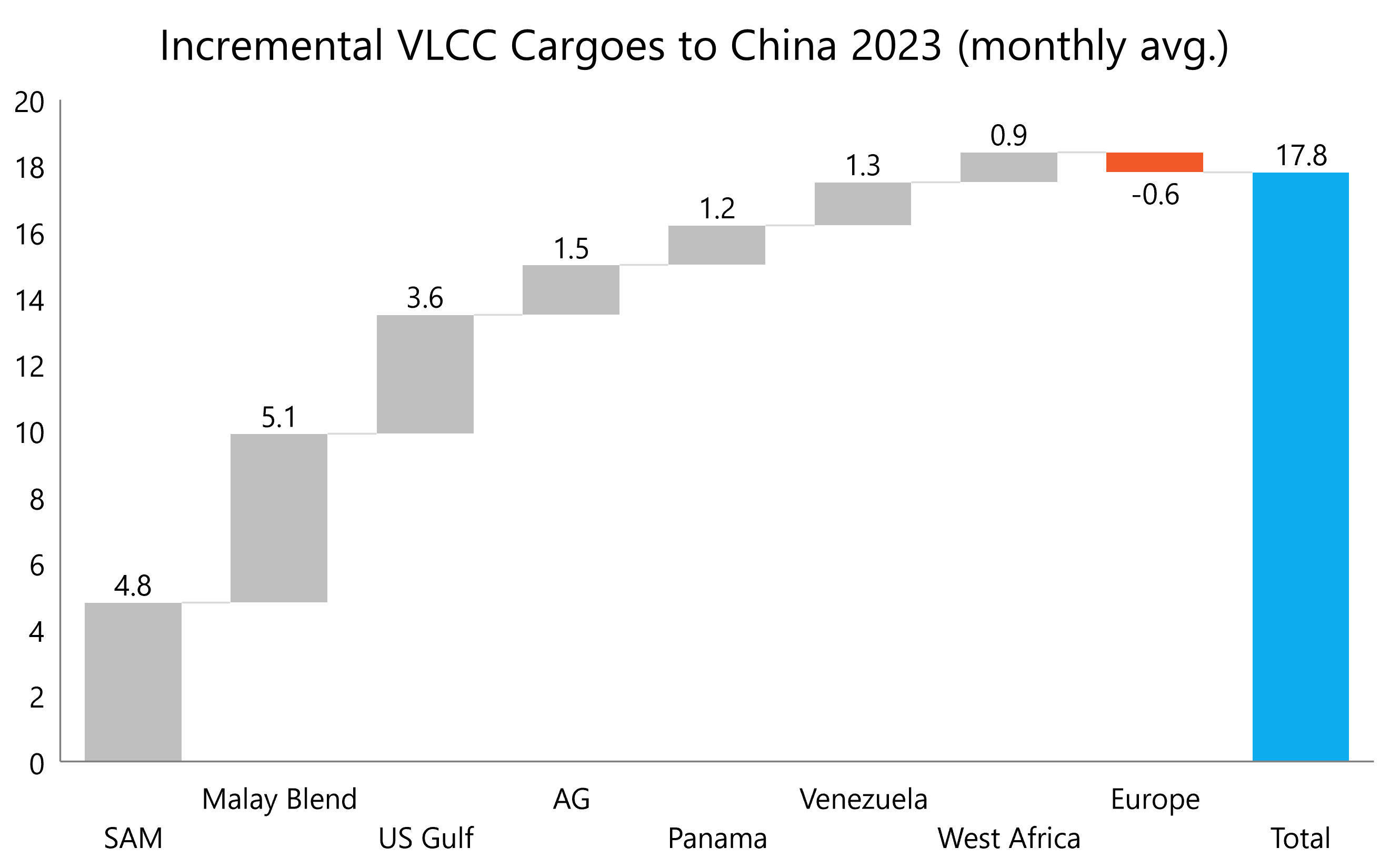

As China stepped out of its Covid bubble in 2023, we saw the country return to record crude import levels and, with that, a new surge in VLCC activity. Our fixture data counts an average of 17.8 additional VLCC cargoes per month into China in 2023 compared to the year prior.

We have seen a shift in the supply picture, where many Middle Eastern suppliers have been cutting production, and this has left the door open for South American and US suppliers to fill the gap. We note an increase of 4.8 monthly cargoes from South America and 3.6 additional cargoes from the US heading to China in 2023. The tonnemile effect of this shift has been hugely beneficial to the VLCC segment.

Another point to note is 5.1 additional cargoes of the so called “Malaysian Blend” which is lifted from Singapore. These are most likely masked Iranian barrels being re-branded before being sold on.

Going into 2024 Chinese growth is expected to slow down. However, crude demand is still set to rise, and with that, the market will continue to build on an already strong foundation of VLCC activity into the country.